« Archive for April, 2008

posted by

Shawn Hoffman, on April 29th, 2008 at 07:43 am, in category Uncategorized

Been a while, so here’s a quick catch up:

- I’m not sure what to make of the Wayne Krivsky firing, nor am I sure what to make of Walt Jocketty’s hiring. From an outsider’s perspective, it’s extremely difficult to make a judgment on an executive who doesn’t have a long track record. As much as we could criticize him for having a fetish for middle relievers at times, he did a lot of good things, and has left the team in fairly good shape going forward. That’s more than you could say for a lot of GMs. I’m fairly certain Krivsky will get another shot, and maybe we’ll get a better read the second time around.As for Jocketty, he’s about as old school as you get, and I believe was vastly overrated during his time in St. Louis. The Cards’ glory years were mostly due to three superstars, and the team disintegrated when two of those stars collapsed. And while it’s unfair to summarily dismiss the acquisitions of Albert Pujols and Jim Edmonds as pure luck… well, that’s just my opinion.

- In other news, the Pirates finally got sick of trying to make the best out of Dave Littlefield’s last incredibly odd mistake. There was some doubt last summer whether Matt Morris was truly done; there’s none now, barring a Troy Percival-like resurgence. You could this officially closes the book on Littlefield’s time as GM, but the Pirates will still be feeling the effects for the next several years. For those who have been bashing Krivsky, keep in mind that Littlefield had his job for over six years.

- I don’t think anybody thought Barry Zito would be quite this bad, so give Brian Sabean that much. 11 Ks and 15 BBs in 28 2/3 IP is very ugly, especially for a fly ball pitcher. This isn’t a completely sunk cost yet, a la Russ Ortiz or Matt Morris, as Zito could still be a passable starting pitcher at some point. But this is going to be a tough ship to steer over the next few months, and possibly years.

- My Google Reader is packed to the brim everyday, mostly with baseball, business, and technology news. I spent much of today skipping through articles about Miley Cyrus and Mindy McCready. I’m still deciding which story is more annoying, but this is a very tough call.

Feedback? Write a comment, or e-mail the author at shawn(AT)squawkingbaseball.com

posted by

Shawn Hoffman, on April 22nd, 2008 at 08:14 am, in category Uncategorized

If you’re a Yankees fan, you have every right to be horrified.

If you’re a Yankees fan, you have every right to be horrified.

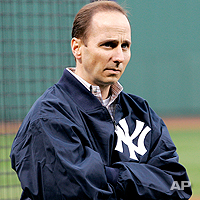

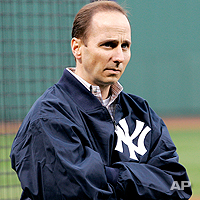

On one side is the shrewd, thoughtful, and, above all else, competent general manager, defending a perfectly rational decision that was made by people who know what they’re doing.

On the other side is a loud, nonsensical owner who sounds more like a Mike and the Mad Dog caller than a baseball executive. The apple doesn’t fall far from the tree, I guess.

I used to wonder about Brian Cashman, back when the Yankees were in their Carl Pavano/Jaret Wright phase. Was it Cashman making those horrendous decisions, or was it George Steinbrenner? Would a good general manager really put his name on such obviously poor moves?

I always figured we’d have to wait until he either had another job, or wrote a book. But as fate would have it, George valued Cashman enough to give him nearly full control of baseball operations, instead of seeing him walk away at the end of the 2005 season. After years of battling, Cashman finally had his chance to steer his own ship.

Since then, he has more than proven his wares, making the roster younger and cheaper while keeping the team in baseball’s highest competitive stratum. For the first time in over a decade, the Yankees introduced a string of young, homegrown players (Robinson Cano, Chien-Ming Wang, Melky Cabrera, Phil Hughes, Joba Chamberlain, Ian Kennedy) into their regular lineup. When needed, Cashman has been able to change on the fly, as he’s proven in each of the last two seasons.

But now, just like that, it could be over.

With George on permanent sabbatical, Hank seems intent on creating unneeded tension, inevitably leading to Cashman walking out the door at the end of the season. The fact that Hank is doing so in such an obvious manner (bringing internal conflicts directly to the press, and not for the first time) is laughable, and speaks volumes about the quality of businessman that now runs the New York Yankees.

Hopefully, Brian Cashman will end up in a new job where his abilities will be fully utilized and valued. He may not be the best general manager in the game right now (there’s no way to really know, given the circumstances), but he’s certainly in the upper tier. Whoever he ends with (whether it is in baseball or something else entirely) will be lucky to have him.

Good luck to Hank finding a replacement, one that I’m sure will be more amenable to following his whims.

Feedback? Write a comment, or e-mail the author at shawn(AT)squawkingbaseball.com

posted by

Shawn Hoffman, on April 20th, 2008 at 04:03 pm, in category Uncategorized

We spent a good amount of energy discussing the Rays’ choice to send Evan Longoria to AAA, in order to control his services for an extra year. The plan seemed straightforward enough, and I was convinced it was the right move.As you know by now, the Rays were thinking even further ahead. In what may be an unprecedented deal, the team signed Longoria to a six year contract (with team options that run all the way through 2016) just six games into his Major League career. He will be guaranteed $17.5 million over the first six years, which includes 2008. This covers his three pre-arb seasons, as well as three of his four arb-eligible years (since he was sent down for only the first two weeks, Longoria would have been a “super two” after the 2010 season). The club then has an option on him for 2014 (his last arb-eligible year), and a subsequent one for 2015 and 2016 (his first two FA-eligible years).

We spent a good amount of energy discussing the Rays’ choice to send Evan Longoria to AAA, in order to control his services for an extra year. The plan seemed straightforward enough, and I was convinced it was the right move.As you know by now, the Rays were thinking even further ahead. In what may be an unprecedented deal, the team signed Longoria to a six year contract (with team options that run all the way through 2016) just six games into his Major League career. He will be guaranteed $17.5 million over the first six years, which includes 2008. This covers his three pre-arb seasons, as well as three of his four arb-eligible years (since he was sent down for only the first two weeks, Longoria would have been a “super two” after the 2010 season). The club then has an option on him for 2014 (his last arb-eligible year), and a subsequent one for 2015 and 2016 (his first two FA-eligible years).

Given how uncertain I was about the Chris Young contract due to his lack of performance to date, I feel strange supporting this one outright. But make no mistake, this is a tremendous deal for Tampa Bay. Sky has the math on it, but it’s really very simple: if Longoria turns into Abraham Nunez, the Rays will be out ~$10-15 million in terms of value. If he turns into an all star-caliber player (a much more reasonable scenario), they would be looking at a surplus that dwarfs that previous figure.Like with Young’s deal, much of that potential surplus comes from the club option years, which the Rays take on with almost zero added risk (there is a $3-4 million buyout if the team declines the 2014 option). Even if Longoria hits all of his escalators, he would be looking at just $7.5 million in his last arb-eligible season, and then $25 million for his first two free agent years. That is exceedingly cheap in 2008 dollars, let alone 2014-2016 dollars.

Also, for all the consternation it caused, two weeks of Willy Aybar (who hit .292/.370/.500) saved the Rays several million dollars in the latter years of this contract. The minimum figure we can point to is $3.5 million, which is the difference between his last arb-eligible salary in 2014 and his first FA-eligible salary in 2015. But really we should be looking at the difference between his 2014 salary ($7.5 million) and what would have been his salary in 2016 had it been his third FA-eligible season instead of his second. That number is likely closer to $10 million.

- As for Frank Thomas, this scenario wasn’t entirely unpredictable. His option for 2009 would have kicked in at 350 plate appearances, and the Jays wanted no part of it. Apparently they figured they could simply bench a first ballot Hall of Famer coming off back-to-back good years without causing any internal commotion. Surprisingly enough, they scrapped that plan after one day, releasing Thomas and eating the rest of his 2008 salary.The question now is, what’s next for the Big Hurt? We could repeat this exercise to try to find his best possible fit, but I don’t think it would give us a perfectly obvious solution. Thomas can still hit, but he is not nearly in Bonds’s class, and I’m not sure there is a contending team that could use him everyday. The Angels are the most obvious answer, but even if they had the good sense to throw Garret Anderson aside, Vladimir Guerrero will still need some days off from right field. Tampa Bay is also an option, although that would likely mean Jonny Gomes having to play right field. It’s certainly possible that Thomas could end up with a second division team, but without the lure of a major milestone, I’m not sure who would be that interested.

Feedback? Write a comment, or e-mail the author at shawn(AT)squawkingbaseball.com

posted by

Shawn Hoffman, on April 18th, 2008 at 12:26 pm, in category Uncategorized

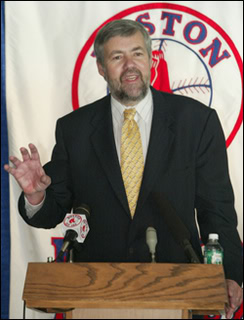

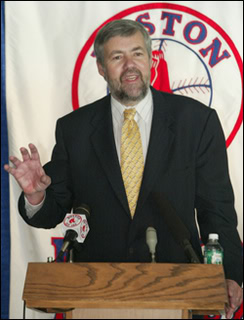

It’s a tradition unlike any other: Major League Baseball executives (particularly the one to your right) criticizing Forbes’ estimates of the industry’s finances.

Tango had a pretty good take on it yesterday:

At the very least, it gives you a starting point and historical perspective. Any baseball executive that allows himself to be quoted by the press that what Forbes does is cr-p is full of the same thing himself. Either you are part of the problem or part of the solution, and giving reasonable numbers as a starting point for bright people to manipulate is far better than not giving any numbers at all.

That’s basically the point. They’re certainly not exact, but they’re also not total crap. In a very big picture sense, while the numbers shouldn’t be used to analyze or castigate a specific team, they can give us a good picture of the industry as a whole.

This last point is especially true with franchise valuations, since they are our only real reference point. John Beamer has written a bunch on how to value teams and whether Forbes’ methods are reliable, so I won’t rehash. But I do believe that they do a fairly decent job (although it’s possible that the numbers become self-fulfilling prophecies, since these articles have become so high profile the past few years).

Consider that MLB’s total P/E ratio is 28.74, which is pretty steep for an industry whose profitability actually fell in the previous year, and whose revenues are likely growing somewhere in the 8-10% range (generally, stocks trade at a P/E 1-2 times the company’s growth rate, in terms of profits).

But this high multiple actually makes plenty of sense, given the extenuating circumstances. For one thing, owning a baseball team isn’t the same as owning a bond insurer; the glamor that comes with it is priced into the P/E. Also, for an owner that controls related assets (i.e. television stations, marketing firms, etc.), a team’s net income is often vastly understated, since it doesn’t take into account the value it creates for those other properties.

We can also see these effects amongst individual teams. I mentioned yesterday that the Nationals, Marlins, Rays, Rockies, Twins, and Padres were amongst the most profitable teams in 2007, while the Yankees and Red Sox were the only teams that took significant losses. Unsurprisingly, this shows up in the multiples. The former six were all among the bottom eight in P/E, with the Marlins bringing up the rear at just seven times last year’s earnings. The Yanks and Sox, meanwhile, were first and third in the league in franchise value, despite their seemingly poor financial performances.

I will say that the disparity between Forbes’ revenue estimate and MLB’s is somewhat annoying, if not necessarily troubling. This year’s gap is more than $500 million, while last year’s was about $300 million, with MLB on the high end of each.

I tend to trust MLB a bit more than Forbes on this one (I don’t really see MLB’s incentive to lie), but there may actually be a couple of logical explanations. The most obvious is MLB Advanced Media, whose revenues very well could have been ~$300 million in 2006, and ~$500-600 million in 2007. Although it’s less likely, MLB could also be including revenues from team owned regional sports networks, although I have a feeling that figure would be much larger than $600 million.

Regardless, as Tango said, the Forbes baseball issue is a very useful starting point. If nothing else, it gives us a slight peek into an extremely closed world, and generally leads to some very good discussion.

Feedback? Write a comment, or e-mail the author at shawn(AT)squawkingbaseball.com

posted by

Shawn Hoffman, on April 17th, 2008 at 10:44 am, in category Uncategorized

I’ve only taken a quick look, so just a few quick notes for now. Much more later.

- The Yankees, obviously, are the highest valued team in the game, coming in at just over $1.3 billion. That’s almost sixty percent higher than the Mets ($824 million) and Red Sox ($816 million).

- Not surprisingly, the Rockies saw the biggest one year change in valuation, rising seventeen percent to $371 million.

- The thirty teams’ combined estimated market cap is $14.15 billion, up nine percent from last year’s $12.94 billion.

- Total revenues came in at $5.49 billion, up 7.7 percent from last year’s estimate, but over half a billion dollars less than MLB’s own (and exalted) number. I haven’t read the full article yet, but I would be surprised if Forbes didn’t address this gap.

- The Yankees, Red Sox, and Blue Jays were the only teams to run at an operating loss. Just as they did the past three years, the Yankees led the way, this time losing $47.3 million. Note that the Yankees and Red Sox are “subsidiaries” in holding companies that have other strongly tied assets (as we covered in part yesterday). Needless to say, some creative accounting can make YES or NESN (which don’t have to share revenue) look extremely profitable.

- On a somewhat related note, the teams that were most profitable were generally low revenue teams. The Nationals set the pace with a $43.7 net income, followed by the Marlins at $35.6 million. The Rays, Rockies, Twins, and Padres also reached the top ten (although the Mets and Braves peeked in there, as well).

- Overall, league-wide income was down about $3 million.

More to come later.

Feedback? Write a comment, or e-mail the author at shawn(AT)squawkingbaseball.com

posted by

Shawn Hoffman, on April 16th, 2008 at 08:55 am, in category Uncategorized

If you don’t already know about Fenway Sports Group, it’s a very intriguing story. In 2004, New England Sports Ventures (the holding company for the Red Sox and NESN) created FSG to serve as a marketing and consulting firm, mainly in the sports realm. From Maury Brown:

FSG is engaging in everything from a ownership of a NASCAR team (Roush Fenway Racing), to a marketing and sponsorship partnership agreement with Boston College athletics in which FSG’s involvement has fueled a large expansion of the athletic department’s corporate sponsor base, to FSG co-owning an AVP Pro Beach Volleyball tournament, and other ventures such as a partnership with the PGA Tour’s Deutsche Bank Championship. FSG and the Red Sox remain closely tied, but that is changing as FSG continues to grow and mature.

And now this from Maury on Monday:

Fenway Sports Group (FSG) today announced that Dunkin’ Donuts, the world’s largest coffee and baked goods chain, has selected FSG as its sports marketing agency of record.

In this role, FSG will help Dunkin’ Donuts shape its sports marketing strategy, develop programs that leverage Dunkin’s current broad-ranging portfolio of marketing assets, and maximize the value of its future sports, entertainment and event marketing partnerships.

FSG will also work with Dunkin’ Donuts’ national sponsorships team and field marketing managers to negotiate potential sports properties, agreements, and provide tactical support for its national sports marketing calendar programs.

Now, it’s obviously very tough to judge any privately held company’s performance. But with that caveat aside, what fascinates me about this is that the Red Sox are expanding far beyond the walls of Fenway Park, a move that few teams would ever even consider.

As crucial as growth strategies are for almost every other big firm in this country, they are rarely discussed inside the offices of most major sports franchises. Outside of baseball operations, most MLB teams focus on making marginal improvements to existing practices (i.e. streamlining ticket sales, or adding new sponsorship inventory), or implementing short term strategies (i.e. developing a new marketing campaign). Rarely do front office types think in terms of scale, instead relying on the fairly consistent growth of the league’s pooled revenue.

In fact, since the very beginning of the modern league format, the real growth in professional sports has almost always been done collectively (e.g. national television and radio contracts, expanded playoffs, MLB Advanced Media, etc.). There has been a decent amount of innovation relating to existing revenue streams in the past two decades, particularly in stadium construction and design. But even these have become league activities, to a certain extent.

Of course, the big X factor that I haven’t mentioned is winning. Every team benefits from winning on the field, both in terms of short-term revenue and long-term branding. But winning can really only be a part of a long term growth strategy, since no team wins forever.

The key, then, is to find or develop new core competencies, depending on the strength of a given team’s brand and the personnel within the organization. Thirty years ago, Ted Turner saw the Atlanta Braves not only as a baseball team, but as a fantastic entertainment asset that could be integrated seamlessly with his television station.

The Red Sox seem to have accomplished something similar (in spirit, at least) with FSG, which could spawn a number of imitators in the coming years (just as Turner’s venture did). It’s an open question as to whether other teams can be as successful with a similar strategy, but, at the very least, this could potentially encourage others to grow in some form.

There’s clearly a lot more to be said on this, so stay tuned.

Feedback? Write a comment, or e-mail the author at shawn(AT)squawkingbaseball.com

posted by

Shawn Hoffman, on April 11th, 2008 at 08:00 am, in category Uncategorized

I wrote this about MLB.com last month:

I wrote this about MLB.com last month:

In reality, MLB.com is only a very small part of an enormous (and rapidly growing) market for online videos. Music, movies, and television shows are all moving toward free digital distribution, albeit at differing rates. These other outlets have all come to grips with this new reality, and done what is necessary to compete. MLB.com, in taking an anti-competitive approach, continues to unknowingly hurt itself.

Then I ran into this and this, detailing the NHL’s most recent push into online video. This line in particular got me excited:

“We actually support people snagging content of ours,” Mika said. “We love for our fans to share content and to send the links around. It’s something we really encourage.”

Well, they certainly have the right idea (not that MLBAM chief Bob Bowman hasn’t made similar statements about openness and spreading content virally). “The NHL Network,” as it’s called, is free to use, which is always a plus. And it’s nice to hear Andre Mika (the NHL’s VP of broadband and new media production) talk about viral marketing.

But at first glance, the product itself seems fairly generic; very useful if you’re a hockey fan, but only in the same way that MLB.com is useful to baseball fans. There are extensive highlights for every NHL game, as well as a decent amount of original video and audio clips. All of the content is ad supported, which is certainly understandable, if not totally optimal.

But there’s one little button (which I almost missed, actually) that separates these videos from those of the other major sports leagues: they’re embeddable, potentially allowing NHL.com to spread their content far and wide, at no extra cost.

This basic piece of functionality should be part of the fundamental makeup of any content site. Embeds create an off-site presence that can build a tremendous amount of awareness, which almost inevitably drives up traffic numbers. As I rehashed above, not doing so is simply a misguided anti-competitive strategy that does not work in the online space.

The next step for NHL.com, as it should be for MLB.com, is loading up its content base. The easiest way to do so is to allow users to partake. Like MLB.com, NHL.com’s content is distributed in a purely top down fashion: they produce it, you watch it. I won’t rehash all the reasons this model is outdated, but it will be important for these companies to eventually realize the value that lies in user generated content.

That said, this is a step in the right direction. The NHL may have even more incentive than MLB to win in this realm, considering its distant fourth place standing among major sports leagues in the U.S. But while NHL.com may never match MLBAM in sheer revenue, their offerings may already be superior.

The irony of all this is that there are some extremely simple ways for each league (and the NFL and NBA, for that matter) to make major headway. It’s just a matter of leaving their anti-competitive comfort zones, and embracing the openness of the web.

Feedback? Write a comment, or e-mail the author at shawn(AT)squawkingbaseball.com

posted by

Shawn Hoffman, on April 8th, 2008 at 10:01 pm, in category Uncategorized

The full details of the contract are out: $28.5 million through 2013, plus an $11 million club option for 2014. All told, the deal buys out his three arbitration-eligible seasons and at least one (but possibly two) FA years.

Now we can start to see the potential cost savings that I was skeptical about yesterday. Let’s make some low end estimates. If Young only turns out to be a decently above average center fielder, he likely would have made about $20 million in arbitration, and ~$12 million a year in free agency. That equates to around $45 million through 2014, counting the $1 million or so he would have made pre-arb.

That’s only $5 million in savings, but remember, these are fairly low end guesses (keep in mind that Torii Hunter got $18 million per year). And the key difference from what we knew yesterday is the club option for 2014, which creates a potential windfall surplus for the team with no added risk. If Young turns out to be a stud, this deal could easily turn into a net gain of $20 million, or even more than that depending on the industry’s growth rate.

There’s always the chance Young doesn’t progress as a hitter, or has to move to a corner outfield spot, or gets hit by a bus, all of which would significantly hurt his value going forward. But there’s more upside to this deal than it seemed like twenty-four hours ago. I’m still not sure I wouldn’t have waited another year, but the potential reward now outweighs the potential risk.

Feedback? Write a comment, or e-mail the author at shawn(AT)squawkingbaseball.com

posted by

Shawn Hoffman, on April 8th, 2008 at 07:44 am, in category Uncategorized

- I’m not sure how I feel about long-term deals for players with one full year of service time (i.e. Troy Tulowitzki, and most recently Chris Young). The teams seem to be taking on much of the risk, in exchange for relatively minimal cost savings down the road. If Chris Young turns out to be a stud centerfielder (which he hasn’t been to this point, PECOTA aside), the D-Backs will control his rights for an extra year at a relatively low price, saving several million dollars. But if Young flops, Arizona will be on the hook for many more millions than they ever could have saved.In all likelihood, Young will come somewhere in between, and this deal won’t look particularly good or particularly bad (which is why I have trouble criticizing it outright). But having an extra year of performance to go on certainly wouldn’t hurt, given the long-term nature of these deals.

- As exorbitant as $9.5 million seems for a player with no professional experience, Scott Boras is right to push these limits; smart teams know how high the ROI is for first round picks as a whole (and this is particularly true for the first overall pick in most drafts). A draftee’s signing bonus is essentially the price of that player’s first three years in the big leagues. No matter how you look at it, a three year, seven-digit deal with a top amateur is always a good bet.

- Neal Huntington said last fall that the Pirates were in even worse shape than he had thought when he originally took over as general manager. Well, I can’t even imagine what the Giants’ next GM will say. As Joe Sheehan put it, San Francisco’s lineup “calls to mind the waning days of the Rachel Phelps Era.” They’ve scored sixteen runs in seven games, and while it’s far too early to make any real conclusions, we knew coming in that this could be a historically bad offense if things broke wrong. And no, there isn’t much help coming any time soon either (remember when Brian Sabean used to purposely sign Type A free agents in order to give up his first round picks?), barring a major midseason pickup.

Feedback? Write a comment, or e-mail the author at shawn(AT)squawkingbaseball.com

posted by

Shawn Hoffman, on April 3rd, 2008 at 07:46 am, in category Uncategorized

Some interesting items from a Q&A Bill James did with the NY Times’s Freakonomics blog:

Some interesting items from a Q&A Bill James did with the NY Times’s Freakonomics blog:

A: Over time, every hitter will hit better when he has the platoon advantage than when he does not. There may be an exception, maybe two exceptions. You see a lot of reverse splits or backwards splits in one-year data Ñ lefties hitting better against lefties, etc. Over time, at least 99 percent of hitters are going to hit better when they have the edge, and certainly the difference is significant.

Amen. I almost never look at one-year platoon splits, since they rarely (if ever) tell us anything meaningful. As Bill said, almost every player will have normal platoon splits over a long period of time, and the great majority will have them fall into a fairly similar range. Not to pick on BP, but they seem to pack more and more of these splits into their book’s player comments each year, and I really can’t understand why.

Q: Is clutch hitting a repeatable/retain-able skill?

A: I donÕt know.

This is technically the right answer, I guess. But my response would be, “Why should I have to prove a negative?” There is no objective evidence that “clutch hitters” exist. If you want to poke holes and say that there is no conclusive evidence that they don’t exist, I would refer you to my friends Big Foot, the Boogie Man, and the Flying Spaghetti Monster.

Q: Should M.L.B. subsidize the use of wood bats in college baseball?

A: IÕll vote for it. I think the biggest problem is: where do you draw the line? There are 900-some college baseball teams, letÕs say about 20,000 college baseball players. How many bats per player are we going to subsidize? Do we subsidize UC-Riverside and Egbert State the same? Also, IÕm not sure there are that many trees.

This one I don’t agree with, unless there is some underlying savings model that I’m completely missing. I worked with a major college program for three years, and this issue was brought up many, many times. But as much as it might serve some kind of purpose for scouts (and the schools, obviously), I can’t imagine that it would bring any real ROI to the MLB teams.

A: Oh, we do horrible analysis sometimes. There will never be a shortage of B.S. What we do, essentially, is to pick up things that people say and ask ÒIs that true?Ó This can be done with regard to almost anything Ñ any sport, including politics. The people who analyze politics on television say absolutely ridiculous things with a frequency that would make the laziest baseball announcer look like Socrates by comparison.

This is very true, and I’m not sure most baseball fans realize it. I would say the majority of journalists (if not the overwhelming majority) in any given field are fairly clueless when it comes to analyzing their subjects. It takes a vastly different skill set to be a writer or a television anchor than it does to be, say, an economist. And yet due to the nature of their jobs, journalists are regularly forced into this double duty. I’m not necessarily defending sports columnists that regularly misinform their audiences, but it’s something media companies may need to consider as information becomes easier and easier to access.

Feedback? Write a comment, or e-mail the author at shawn(AT)squawkingbaseball.com

If you’re a Yankees fan, you have every right to be

If you’re a Yankees fan, you have every right to be  We spent a good amount of energy

We spent a good amount of energy

I wrote this about MLB.com last month:

I wrote this about MLB.com last month: Some interesting items from a

Some interesting items from a